Most small business owners are neglecting the due diligence process when starting or purchasing a business, and when choosing between a franchise or independent business model, often spending hundreds of thousands of dollars without appropriate research.

The findings come from a 2015 collaborative report conducted by Griffith University and the UNSW, funded by CPA Australia.

The report classified due diligence as “the process of ensuring that investors are getting what they think they are buying and what they are buying is worth what they are paying”.

The researchers interviewed 60 current and former small business owners (20 employees or less) for 45 minutes – 28 franchises and 32 independents.

They found that of the franchises, a worryingly high 10 of the 28 (36 per cent) did not consult a lawyer and 13 of the 28 (46 per cent) did not consult an accountant before they purchased their franchise business. These figures were even higher for independent businesses.

Staggeringly, 43 per cent of the franchise business owners did not speak to other franchisees as part of their due diligence and only one (former) franchisee mentioned the need to undertake due diligence on the franchisor.

“The fact that no other franchisees mentioned the franchisor suggests that prospective franchisees may tend to inherently trust the franchisor, thus neglecting to investigate the qualifications and business background of the franchisor business and personal background of the franchisor,” the report states.

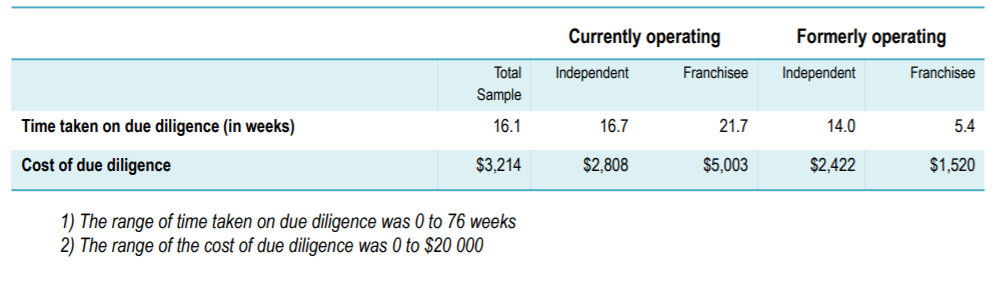

Overall, for both franchises and independent businesses, the time and money spent on due diligence was not proportionate to the time and financial investment of starting that business.

With the survival rate of all Australian small businesses employing up to 19 people between June 2011 and June 2015 only being 62 per cent on average – and with the survival rate of new businesses even worse than that, appropriate due diligence and planning could be the difference between your business scaling or failing.

Franchise vs Independent:

Franchises can be a very successful business model, however some chains have come under criticism for onerous conditions that make it hard for franchisees to make a profit.

Some are better than others, which increases the necessity of appropriate due diligence.

As well as engaging accountants, specialist franchise lawyers and speaking to former and current franchisees, due diligence should include a deep analysis of the Franchise Disclosure Document (FDD), according to Director of Cashflow It Finance, a franchise-specialist finance company.

“The FDD will tell you if there are any legal proceedings against the franchisor, the history of the directors and most importantly it will tell you how many stores have ceased to trade, how many have been sold, how many have been bought back by the franchisor and it will list any previous and current franchisees and their contact details,” Mr Toms said.

The document will also list any franchisor and franchisee responsibilities and restrictions which should be weighed up against the up-front and ongoing fee schedule, he added.

Due diligence should also analyse up front and ongoing fees benchmarked against franchisor support offerings such as leasing teams to help you secure a high quality location, business training, and marketing, operational, OHS, payroll, software and other compliance support.

Conditions such as a refurbishment clause (usually around every five years) and a non-performance clause should also be factored.

That due diligence will then give you the insight to analyse whether that particular franchise model – or indeed franchising – adds enough value in services, skills and support to offset the conditions.

“Some franchises will be more restrictive or onerous than others, however you might decide that those restrictions are worth it for the brand’s offering,” Mr Toms said.

“Likewise with fees. If you are paying more fees but getting more value, then it may still be a good investment.”

Rules make the franchise:

Franchise models are often criticised for the rules and regulations, such as requiring businesses to only order stock through them, however it is these rules that give franchises their strength, according to Mr Toms.

“The public buy from franchises because they know what they are going to get. They get consistency. If you are buying product from different suppliers, you don’t get that consistency and it undermines that whole reason that a franchise exists,” he said adding that most franchises don’t inflate the prices and in many cases have dedicated supply chain divisions to source competitively priced products.

“Brands spend millions of dollars on researching and developing their identity and it is easy to undermine that,” Mr Toms said, adding that stock pricing and channels analysis should form part of the due diligence process.

However he added that sometimes those rules can make life difficult, giving the example of the pizza wars.

“A franchisor can force you to sell a product at a particular price. Generally they receive a percentage of your businesses’ gross income. If you are selling $5 pizzas, you will probably sell lots of them and your gross revenue will go up, but your margins and therefore your net revenue and profit can go down,” he said.

Once again, appropriate due diligence will serve you well.

Franchise leasing assistance:

Most franchisors have leasing teams who will assist in identifying quality locations for the business and in negotiations with landlords, which can take the burden off ensuring your offering matches your market.

“Often they will have analysed demographic data and determined specific locations that fit with their business model,” Mr Toms said.

“Sometimes the franchisee will come to a brand requesting feedback on a site and other times the franchisor will have identified a number of suitable premises.”

“Sometimes the franchisor they will even take the head lease and find a suitable franchisee to operate it.”

Furthermore, having the backing of a franchise may provide landlords with peace of mind and make it easier to secure a suitable lease.

Expectation and satisfaction

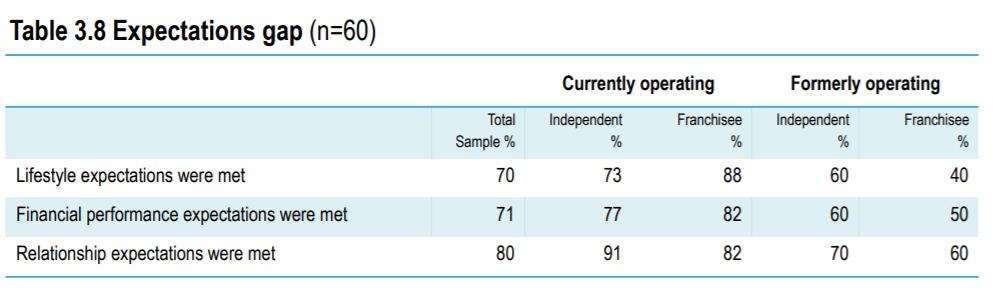

Business owners surveyed in the report generally said their business met their expectations around lifestyle, financial performance and relationships but that they had to work very hard in the beginning.

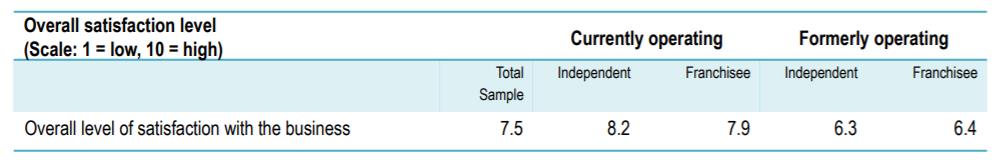

Overall satisfaction levels of business owners were similar, regardless of the business model, although those currently operating were more satisfied than those formerly operating.

Individual Choice:

Ultimately, running a business is tough, however you do it, but with potentially amazing rewards. For some people, it might be easier having the support, structure and systems of a franchise, while others might find the value proposition does not add up, or the restrictions too onerous and will prefer to make their own way.

However you choose to do it, conduct plenty of due diligence to enable informed decisions, and then give it everything! Good luck!